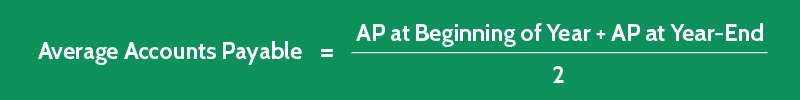

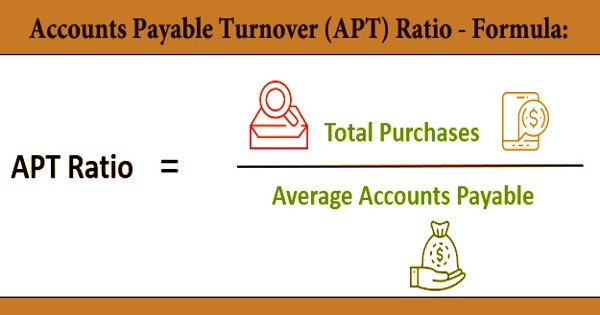

Also, the desire to achieve a high asset ratio could drive management to cut back on necessary investments in fixed assets, or to stock finished goods in such low volumes that deliveries to customers are delayed. For example, a low rate of liability turnover could be related to deliberate payment delays past terms, which could result in a company being denied further credit by its suppliers. The use of efficiency ratios can have negative effects on a business. Conversely, a low liability-related ratio implies management effectiveness, since payables are being stretched. If an asset-related ratio is high, this implies that the management team is effective in using the minimum amount of assets in relation to a given amount of sales. Understanding Efficiency RatiosĮfficiency ratios are used to judge the management of a business. Thus, if a supplier demands short payment terms and that is the only available supplier for a key part, then there is little management can do to improve on this ratio. Changes to this ratio are limited by the underlying payment terms agreed to with suppliers. Accounts Payable TurnoverĪccounts payable turnover is calculated as total purchases from suppliers divided by average payables. This turnover level varies substantially, depending on the nature of the business and the level of investment it requires. A high turnover ratio can be achieved by outsourcing the more asset-intensive production to suppliers, maintaining high equipment utilization levels, and avoiding investments in excessively expensive equipment. It is also necessary to maintain work-in-process in front of bottleneck operations, to ensure that they never run out of work.įixed asset turnover is calculated as sales divided by average fixed assets. However, it is possible to shrink inventory levels too much, if doing so results in longer delivery times to customers. A high turnover rate can be achieved by minimizing inventory levels, using a just-in-time production system, and using common parts for all products manufactured, among other methods. Inventory turnover is calculated as the cost of goods sold divided by average inventory. Conversely, a company might elect to have low receivables turnover as a result of a strategy to sell to lower-quality customers to which competitors refuse to sell. A high turnover rate can be achieved by being selective about only dealing with high-grade customers, as well as by limiting the amount of credit granted and engaging in aggressive collection activities. The following are considered to be efficiency ratios: Accounts Receivable TurnoverĪccounts receivable turnover is calculated as credit sales divided by average accounts receivable. To judge performance, these ratios are typically compared to the results of other companies in the same industry. In the case of liabilities, the main efficiency ratio compares payables to total purchases from suppliers. In the case of assets, efficiency ratios compare an aggregated set of assets to sales or the cost of goods sold.

A highly efficient organization has minimized its net investment in assets, and so requires less debt and equity in order to remain in operation. Please read more on our technical analysis and fundamental analysis pages.Efficiency ratios measure the ability of a business to use its assets and liabilities to generate sales. Understanding these patterns can help to make the right decision on long term investment in Unilever PLC. We offer a historical overview of the basic patterns found on Unilever PLC Financial Statements. Cash flows can provide more information regarding cash listed on a balance sheet, but not equivalent to net income shown on the income statement. The changes in Unilever PLC's assets and liabilities, for example, are also reflected in the revenues and expenses that we see on Unilever PLC's income statement, which results in the company's gains or losses. Accounts Payable Turnover Ratio: The accounts payable turnover ratio is a short-term liquidity measure used to quantify the rate at which a company pays off its suppliers. Although Unilever PLC investors may use each financial statement separately, they are all related. Unilever PLC investors use historical funamental indicators, such as Unilever PLC's Accounts Payable Turnover, to determine how well the company is positioned to perform in the future. It usually determines the ability of a company to manage and pay its liabilities to suppliers. These documents include Unilever PLC income statement, its balance sheet, and the statement of cash flows. An accounts payable turnover ratio typically measures the number of times a company pays its suppliers during a specific accounting period. There are typically three primary documents that fall into the category of financial statements.

0 kommentar(er)

0 kommentar(er)